Selling your home wouldn’t help pay for care home costs, research shows

New analysis from retirement specialist Just Group has revealed that the average home could cover just seven years of care in a residential home.

According to Stephen Low, communications director at Just Group, ‘The home is often the most valuable asset,’ yet if it is sold, the money from it can’t afford to pay for the full costs of care in a residential home. This harrowing discovery has highlighted that the increased cost of social care requires urgent attention, similar to the reception being given for the energy, food and housing crisis.

Earlier this week, Just Group released their findings from a recent study which found that care costs are outstripping property increases at an alarming rate, meaning if someone were to sell their home in order to pay for care it would only cover them for seven years.

According to recent data from the UK House Price Index, the average house prices in England have risen by about 12% since 2020/21 to more than £300,000 by the end of last year and the weekly cost of care in a residential home has increased by around 20% to £816 a week in the same period.

The analysis from Just Group discovered that London is particularly worse off as the average home prices have risen just 3% compared to care cost increases of 17%.

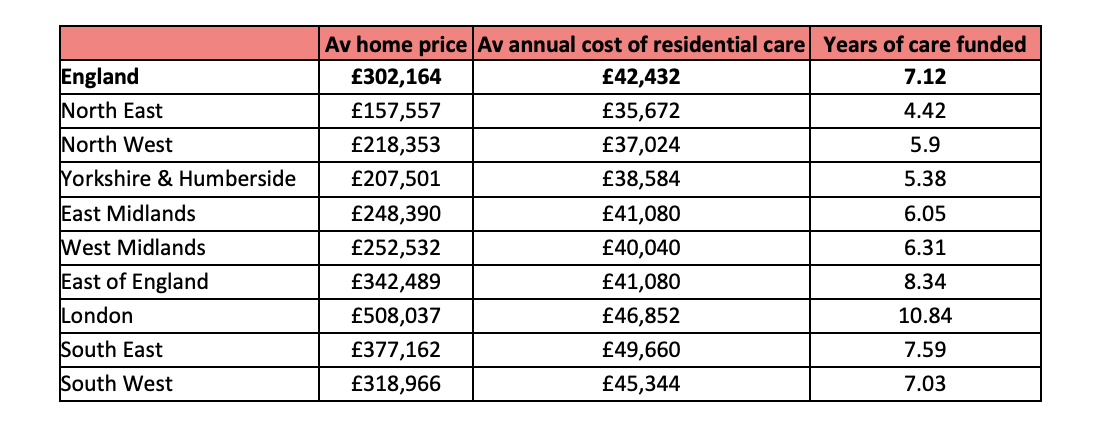

Research from Just Group

Stephen Low said: ‘Research for our annual Care Report found homeowners aged 45+ were more likely to see selling their home as a source of funding than any other option such as pensions, investments or the State. That makes average house value compared to care cost an interesting metric to track.’

‘Our analysis shows selling the average home in England could pay for about seven years of residential care but there is evidence of a North-South divide. In the North East it is four years while in London it is nearly 11 years,’ Stephen added. ‘These are optimistic figures because in the real-world self-funders meeting all their own costs pay higher fees than those receiving some or all council funding, while the costs would be higher still if specialist nursing care were needed.’

Researchers that were involved with the Just Group Care Report from this time last year, found that 40% of respondents would resort to selling their property to help fund care costs.

‘Most people haven’t made alternative plans for paying for care. Reforms that might have helped to protect the value of the home have been delayed and may never be implemented. That means the onus remains on people to find the funds where they can, which is often the home,’ Stephen said.

He claimed: ‘The care sector is facing huge funding pressures and, as we head towards a General Election, voters should look at what answers the politicians are suggesting. People need certainty so they can stop fearing the future and start planning for it.’

Image: Pavel Danilyuk

Extortionate childcare costs forcing Welsh parents into poverty